Home Mortgage Lending in Cuyahoga County

Home Mortgage Lending in Cuyahoga County

With a focus on 3 lenders with Community Benefits Agreements and 6 lenders on a Cuyahoga County Banking Services Contract

The analysis and findings in the full report were originally presented at the Fair Lending and Vital Communities Conference at Cleveland State University on November 8, 2019 and have been augmented with expanded research that was conducted since that presentation. This analysis also supplements mortgage lending research previously published by Western Reserve Land Conservancy in 2018 and 2019.

Executive Summary

The analysis and findings in the pages that follow were originally presented at the Fair Lending and Vital Communities Conference at Cleveland State University on November 8, 2019 and have been augmented with expanded research that was conducted since that presentation. This analysis also supplements mortgage lending research previously published by Western Reserve Land Conservancy in 20181 and 20192.

This report finds that:

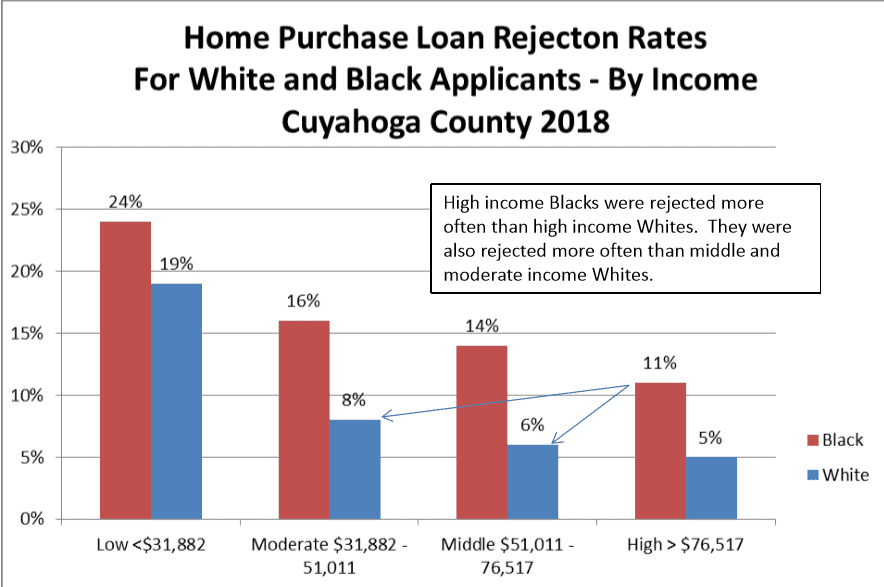

- Significant disparities continue to exist in Cuyahoga County between Black applicants for home mortgage loans and their White counterparts.

- The volume of loans for home repair and home improvement remains low in the East Side of Cleveland, a region of Cuyahoga County with a significant unmet need.

- The lenders that made the highest number of home purchase loans in 2018 in underserved regions of the county were Huntington, First Federal of Lakewood, Howard Hanna, CrossCountry Mortgage, and Lendus Mortgage.

- The lenders that made the highest number of home improvement loans in 2018 in underserved regions of the county were KeyBank and Huntington. However, while Huntington’s home improvement lending has been improving over the past 3 years, KeyBank’s has been declining in this period.

- Among three banks that have entered into agreements pledging to improve their lending (KeyBank, Fifth Third and Huntington) there are notable differences in how the three are meeting credit needs in underserved communities in Cuyahoga County.